Without proper relationship of entries, financial statements could be inaccurate, leading to misinterpretation of a company’s financial health. The date in a gross sales journal entry represents the day when the transaction occurred, making certain accurate journalizing of monetary transactions. In accounting, a credit score is an entry that decreases an asset or liability.

- It organizes transactions, tracks receivables, and reduces errors, kaya mas madali ang paggawa ng financial reports.

- In conclusion, the credit gross sales journal entry is a crucial method for managing buyer accounts and keeping observe of gross sales.

- Sales journals report gross sales and some other explicit metrics related to sales.

- This is because of the truth that gross sales are basically an income-generating operation, so sales are entered within the credit score aspect of the sales journal.

This reflective follow encourages sales professionals to set clear targets, monitor progress, and modify strategies accordingly. Efficient sales journal maintenance provides essential insights into buyer credit score patterns. Common monitoring of credit gross sales through the journal helps identify potential collection points early and helps proactive credit score administration. This systematic strategy strengthens your business’s monetary position.

Cloud-based gross sales journal techniques offer enhanced accessibility and security. Real-time updates and automatic backups ensure your credit sales data are all the time current and protected. These fashionable tools integrate seamlessly with different enterprise systems, offering a complete monetary management resolution. The columnar format of a gross sales journal allows for efficient information entry and evaluation.

Accounting Treatment Of Provident Fund -with Examples

Undertaking your goals and massive wins begins with focusing in your most necessary tasks, not the busy work that makes days slip away. Constructed from productivity ideas, the Sales Journal has been designed that will help you beat procrastination and get extra necessary work done to assist you CRUSH YOUR QUOTA. Understanding the meaning of each debit and credit score can be difficult when you’re coping with returns. So, when a specific product’s quantity goes down, the warehouse is notified of it, they usually put extra purchase orders for that specific. By mentioning the date, we will simply monitor when that exact good was sold.

Moreover, internet credit sales embody gross sales returns and sales allowances. When all credit score gross sales are correctly recorded within the journal, it minimizes the probabilities of errors when entering the information into your accounting software. This journal tracks goods returned by customers or allowances granted for faulty gadgets.

Regular audits and reviews help identify and proper any compliance points promptly. Money gross sales enhance your liquidity immediately because the funds are immediately out there. You document these transactions directly to your cash account, simplifying your accounting course of.

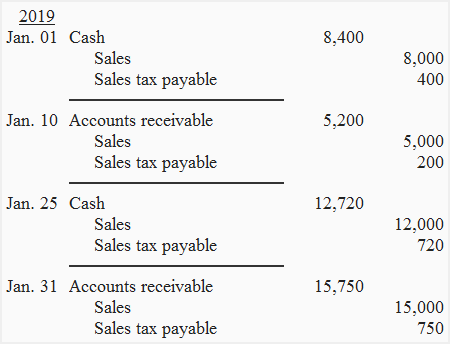

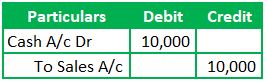

Credit Score Sale With Out Gross Sales Tax

If entries usually are not made on time or made wrongly, it can have an effect on the revenue, tax data, and enterprise well being. Accounting information systems were paper based till the introduction of the computer, so special journals have been widely used. When accountants used a paper system, they had to write the same number in a number of locations and thus could make a mistake. Now that the majority businesses use digital expertise, the step of posting to journals is performed by the accounting software.

Automate your expense administration today by trying Ramp free of charge, or request a demo to get began.

For occasion, if an organization sells $500 worth of merchandise on credit, $500 might be credited to accounts receivable and debited to sales income in the ledger accounts. A credit gross sales journal entry is used to document the revenue from a customer’s purchase on credit. This sort of journal entry is essential because it helps companies hold monitor of the cash that is owed to them by customers. This data is useful in many alternative ways, such as when businesses try to budget for the future or when they are making ready financial statements.

It is used to trace the amount of income generated from the sale of goods https://www.simple-accounting.org/ or services. Gross Sales journal entries usually seize sales-related transactions such as income from items bought, gross sales reductions, and returns. These entries play a crucial function in maintaining an correct document of all sales activities within an organization. At final, evaluate the gross sales journal thoroughly to catch any errors or lacking details. If you apply any discounts, returns, or allowances, adjust the information accordingly by creating the right journal entries, similar to those in the sales returns journal. The sales journal entry is the accounting record made when goods or companies are bought.